Condo Insurance in and around Barre

Barre! Look no further for condo insurance

Condo insurance that helps you check all the boxes

- VERMONT

- NEW HAMPSHIRE

- BARRE

- MONTPELIER

- NORTHFIELD

- RANDOLPH

- WATERBURY

- STOWE

- WAITSFIELD

- WARREN

- RUTLAND

- BURLINGTON

- NEWPORT

- VERGENNES

- SAINT ALBANS

- WINOOSKI

- BRATTLEBORO

- BENNINGTON

- MANCHESTER

- NASHUA

- LEBANON

- WHITE RIVER JUNCTION

- CONCORD

- ROCHESTER

Your Stuff Needs Protection—and So Does Your Condominium.

With plenty of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm easy. As one of the top providers of condominium unitowners insurance, you can enjoy remarkable service and coverage that is competitively priced. And this is not only for your condo but also for your personal belongings inside, including things like cookware, home gadgets and linens.

Barre! Look no further for condo insurance

Condo insurance that helps you check all the boxes

Put Those Worries To Rest

Everyone knows having condominium unitowners insurance is essential in case of a ice storm, blizzard or fire. Adequate condo unitowners insurance lets you know that you condo can be rebuilt, so you aren’t left with the bill for a home you can’t occupy. One important part of condo unitowners insurance is that it also covers you in certain legal cases. If someone falls in your home, you could be required to pay for their hospital bills or their lost wages. With adequate condo coverage, you have liability protection in the event of a covered claim.

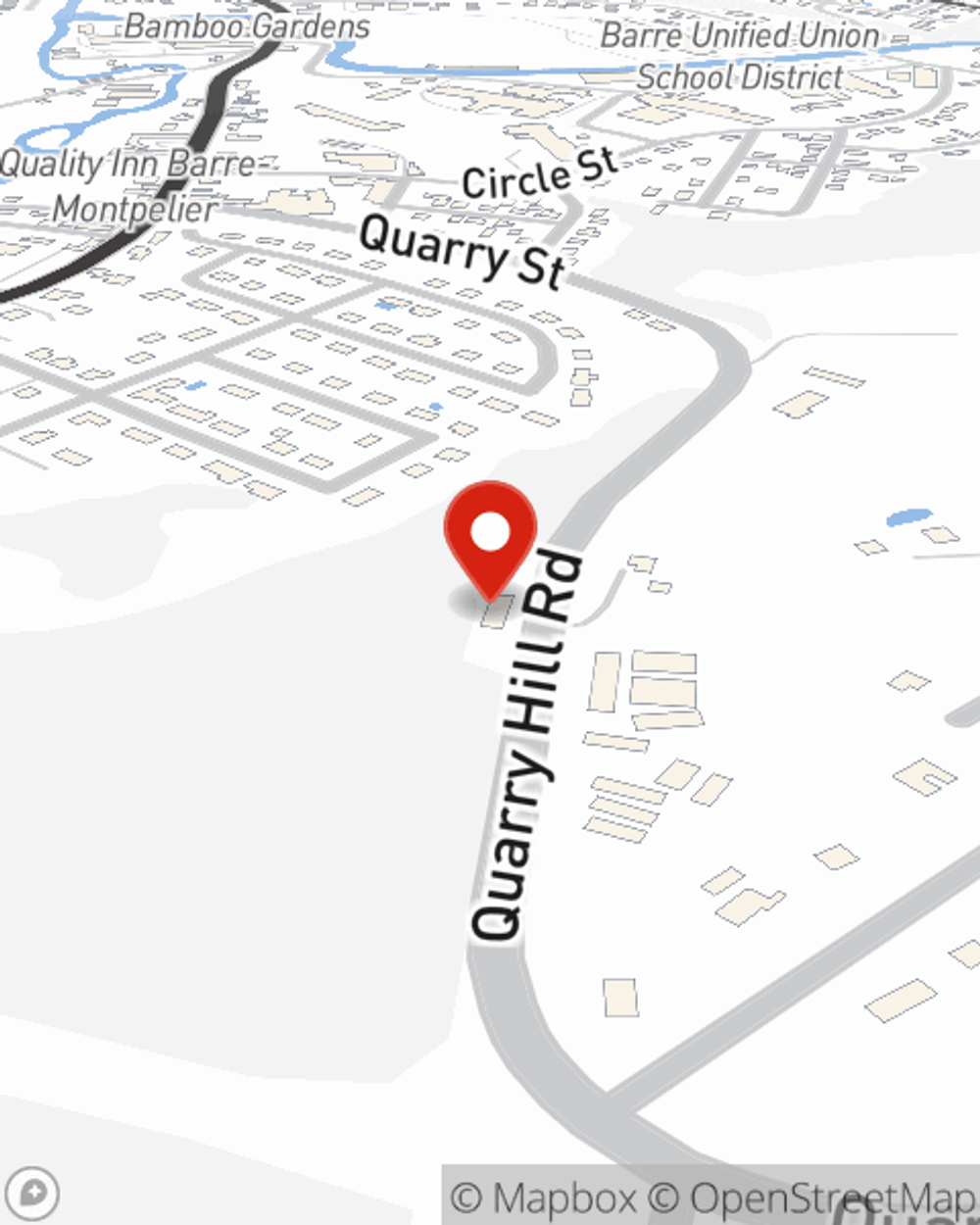

That’s why your friends and neighbors in Barre turn to State Farm Agent Bob Bartlett. Bob Bartlett can walk you through your liabilities and help you find a policy that fits your needs.

Have More Questions About Condo Unitowners Insurance?

Call Bob at (802) 479-3353 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Bob Bartlett

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.